FINANCING

Funding Challenges

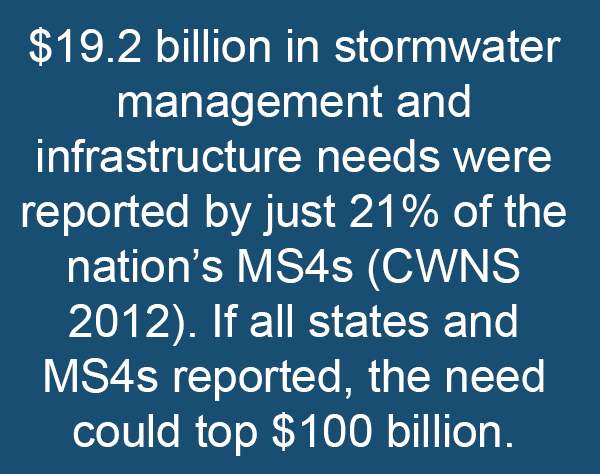

Managing stormwater to improve water quality requires capital investments in infrastructure, and budgets for staff to permit development and enforce requirements, maintain and operate stormwater infrastructure. The EPA’s Clean Watershed Needs Survey (CWNS) periodically estimates the capital investment needed by publicly owned treatment works (POTW). In 2012 (the last public CWNS release), the survey showed that $19.2 billion was needed to plan and implement structural and non-structural stormwater control measures. An additional $48 billion was reported for combined sewer overflow control.

However, only 35 states and 21% of municipal separate storm sewer facilities reported so actual needs are likely much higher. The seven states that reported in 2008, but not in 2012, including North Carolina, represented an additional $7.2 billion. The 2012 totals also do not include $17.2 billion reported by New Jersey in 2008 based on extensive mapping and cost estimates because these were not updated.

However, only 35 states and 21% of municipal separate storm sewer facilities reported so actual needs are likely much higher. The seven states that reported in 2008, but not in 2012, including North Carolina, represented an additional $7.2 billion. The 2012 totals also do not include $17.2 billion reported by New Jersey in 2008 based on extensive mapping and cost estimates because these were not updated.

Of the $19.2 billion, nearly half was needed for stormwater conveyance systems, and about a third for traditional grey infrastructure like retention and detention ponds. States planned to spend $2.8 billion for low impact development and green stormwater infrastructure (e.g. bioretention, swales, wetlands), and $1.5 billion for general management activities like street sweeping, educational programs and asset management.

The American Society of Civil Engineers’ 2017 Infrastructure Report Card gives North Carolina a C- for stormwater infrastructure.

Financial Solutions

In 2016, the Clean Water Management Trust Fund (CWMTF) mentioned in the ACSE Report Card, awarded $27,675, 499 for water quality projects, with $1,306,035 specifically for innovative stormwater management. In 2017, over $67 million has been requested, with $1.8 million for stormwater. The CWMTF funded projects and funding requests can be viewed on their website.

In 2016, the Clean Water Management Trust Fund (CWMTF) mentioned in the ACSE Report Card, awarded $27,675, 499 for water quality projects, with $1,306,035 specifically for innovative stormwater management. In 2017, over $67 million has been requested, with $1.8 million for stormwater. The CWMTF funded projects and funding requests can be viewed on their website.

The Pigeon River Fund, established in 1996 and administered by the  Community Foundation of Western North Carolina, has awarded more than $5.8 million in grants through May 2016 to projects in Haywood, Buncombe and Madison counties (see recent grants for details).

Community Foundation of Western North Carolina, has awarded more than $5.8 million in grants through May 2016 to projects in Haywood, Buncombe and Madison counties (see recent grants for details).

Both the CWMTF and Pigeon River Fund are very important funding sources, especially for non-profits; however, the extensive capital investments needed to manage stormwater at municipal scales require much larger sums and more sustained financing mechanisms. The EPA’s Water Infrastructure and Resiliency Finance Center was launched in 2015 to help states and communities identify innovative financing strategies for water-related infrastructure.

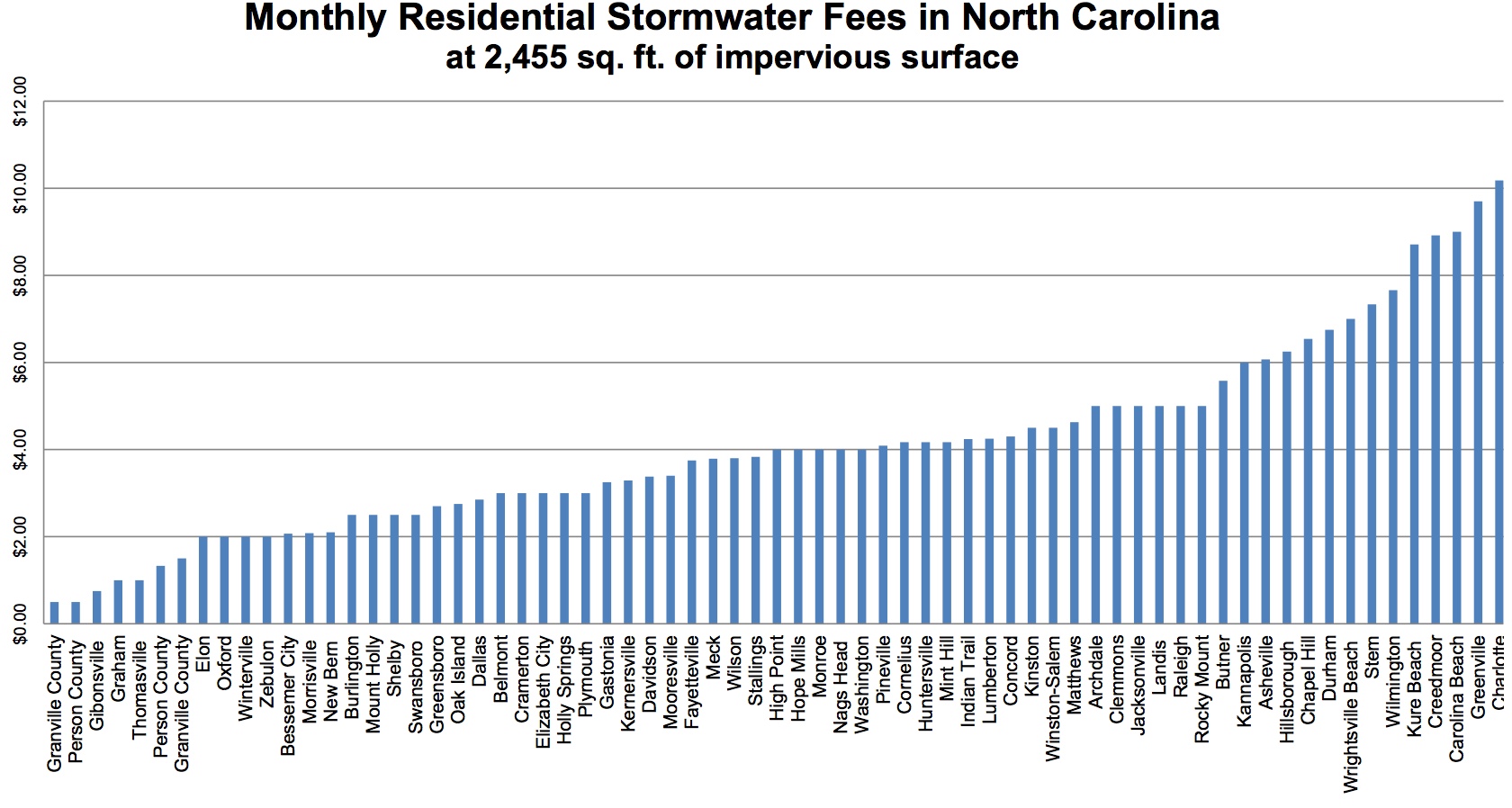

The UNC Environmental Finance Center, which serves EPA Region 4, as part of the Environmental Finance Center Network that supports the EPA’s Water Infrastructure and Resiliency Finance Center, promotes stormwater utility fees as a municipal stormwater revenue source.

The UNC Environmental Finance Center, which serves EPA Region 4, as part of the Environmental Finance Center Network that supports the EPA’s Water Infrastructure and Resiliency Finance Center, promotes stormwater utility fees as a municipal stormwater revenue source.

Comparison of monthly residential stormwater fees. Asheville, the only municipality in WNC with a stormwater fee, falls in the top third at $6.00 for 2,455 sqft. of impervious surface. Source: UNC Environmental Finance Center.

The median rate is $4.00 for 2,455 sqft., roughly $1.60/1000 sqft. of impervious surface. The 63 NC municipalities with stormwater utility fees generated a total of $182,313,937 in revenue in 2015 (UNC EFC).

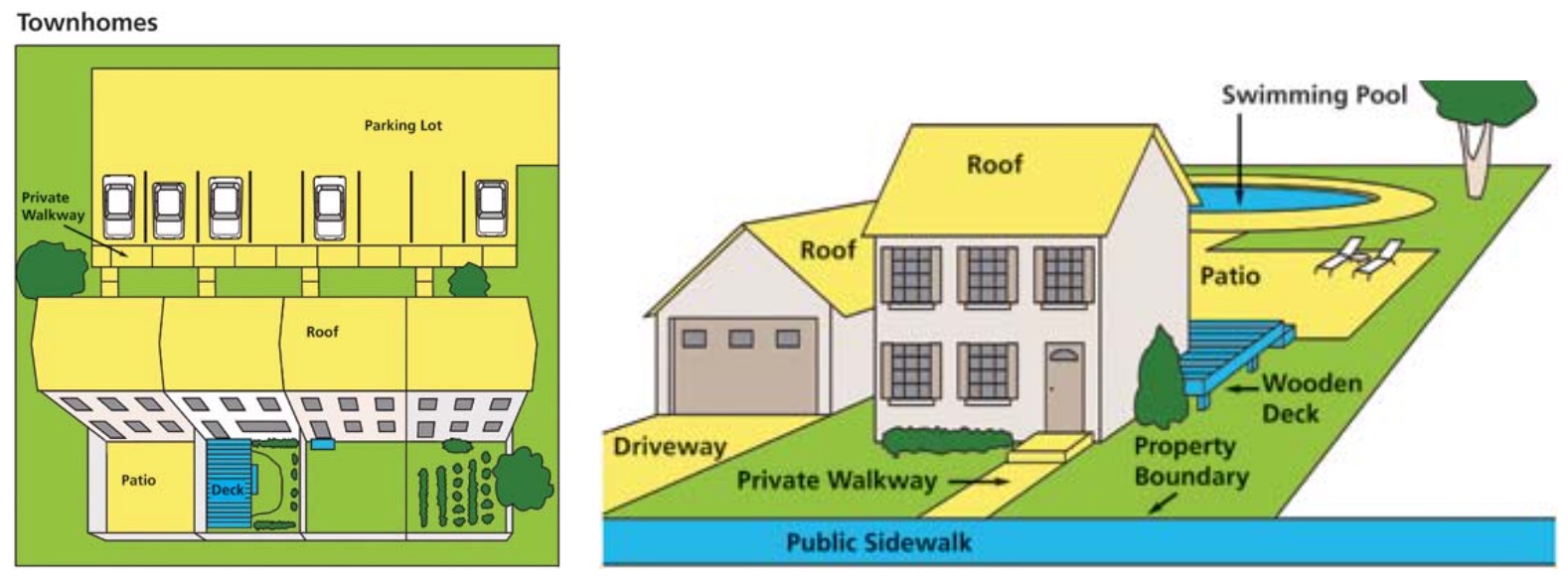

Typical impervious surface areas used in stormwater fee calculations. Source: UNC Environmental Finance Center

Future Directions

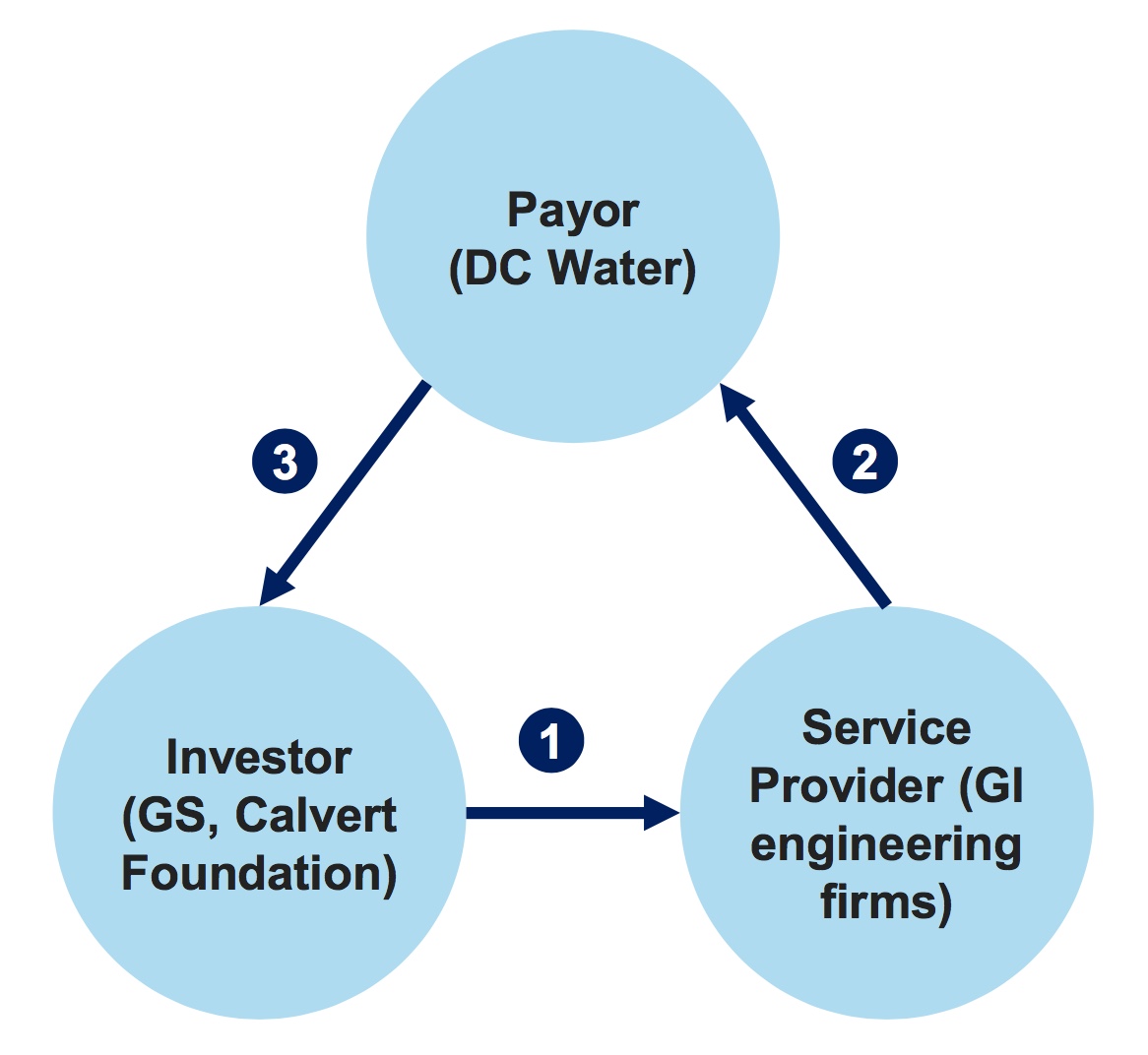

Washington, DC, which already has a stormwater fee and several types of ‘RiverSmart’ incentive programs, is going a step further to accelerate green stormwater infrastructure (GSI) implementation. To offset the potential risk involved in large-scale GSI investments, DC Water (the District of Columbia’s water and wastewater utility) together with Quantified Ventures has developed an environmental impact bond based on a pay for success model.

In the Pay for Success (PFS) model, investors (1) provide capital directly to the design and engineering firms (2) who build the GSI to meet DC Water’s stormwater management performance goals. If the infrastructure exceeds these goals, DC Water pays the investors a return (3). If not, the investors assume the financial loss. Source: Quantified Ventures

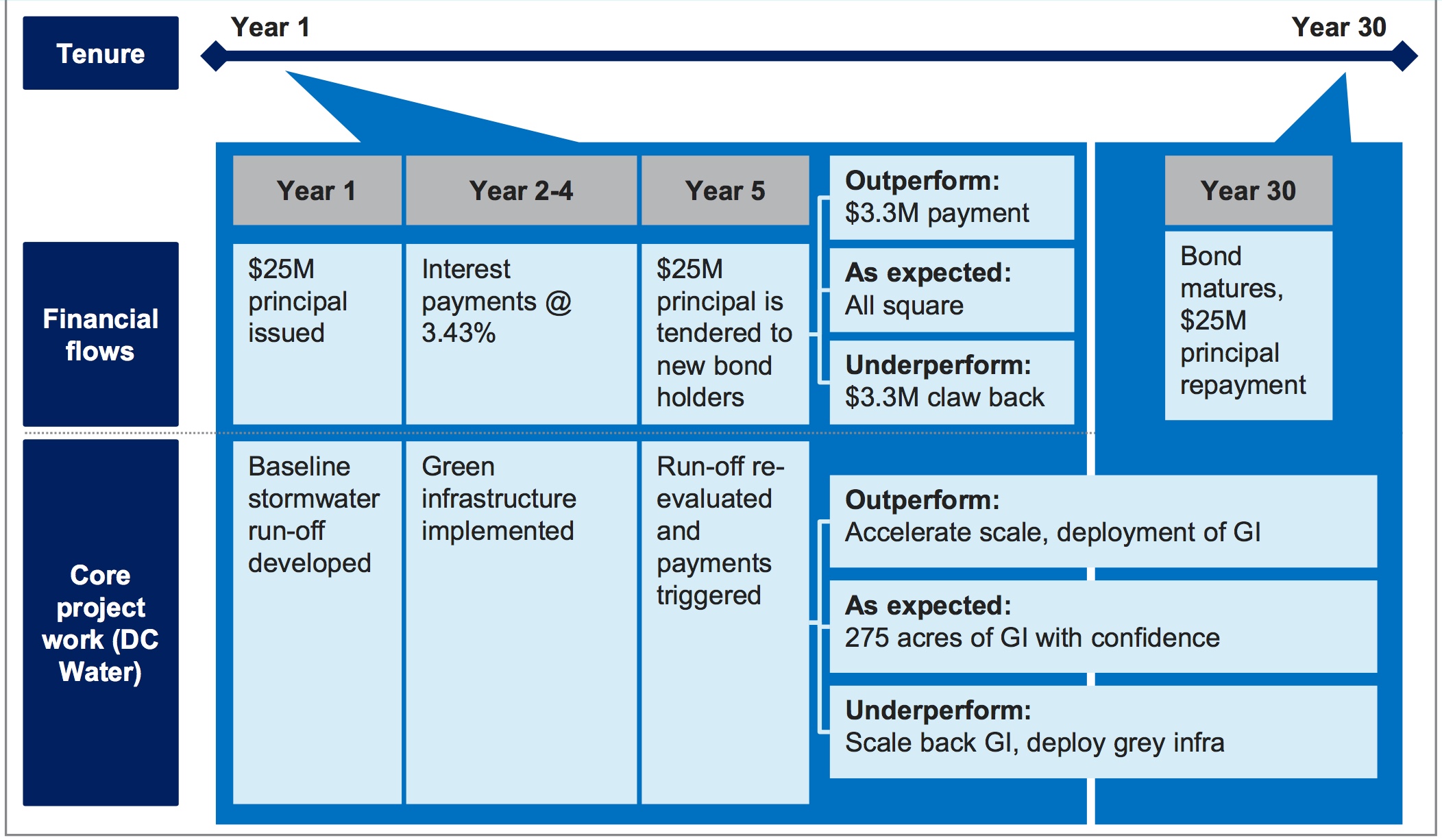

The figure below describes both the financial flows and GSI implementation over the 30-year environmental impact bond tenure. In the first year, a pre-implementation stormwater runoff baseline is established in the project areas in order to be able to measure the post-implementation performance. While the GSI is being implemented the DC Water pays 3.43% interest on the $25 million bond principal that is used for design and construction. In the fifth year, the GSI performance is evaluated, and DC Water pays investors $3.3 million if it exceeds expected performance. If it underperforms, DC Water will scale back GSI and focus more on standard grey infrastructure.

Summary of both the financial and GSI implementation aspects of the PFS model. If the GSI outperforms expectations after 5 years, investors receive a $3.3 million payment. If is performs as expected, there is no performance bonus, and if it underperforms, investors repay DC Water the advance interest payments. Source: Quantified Ventures

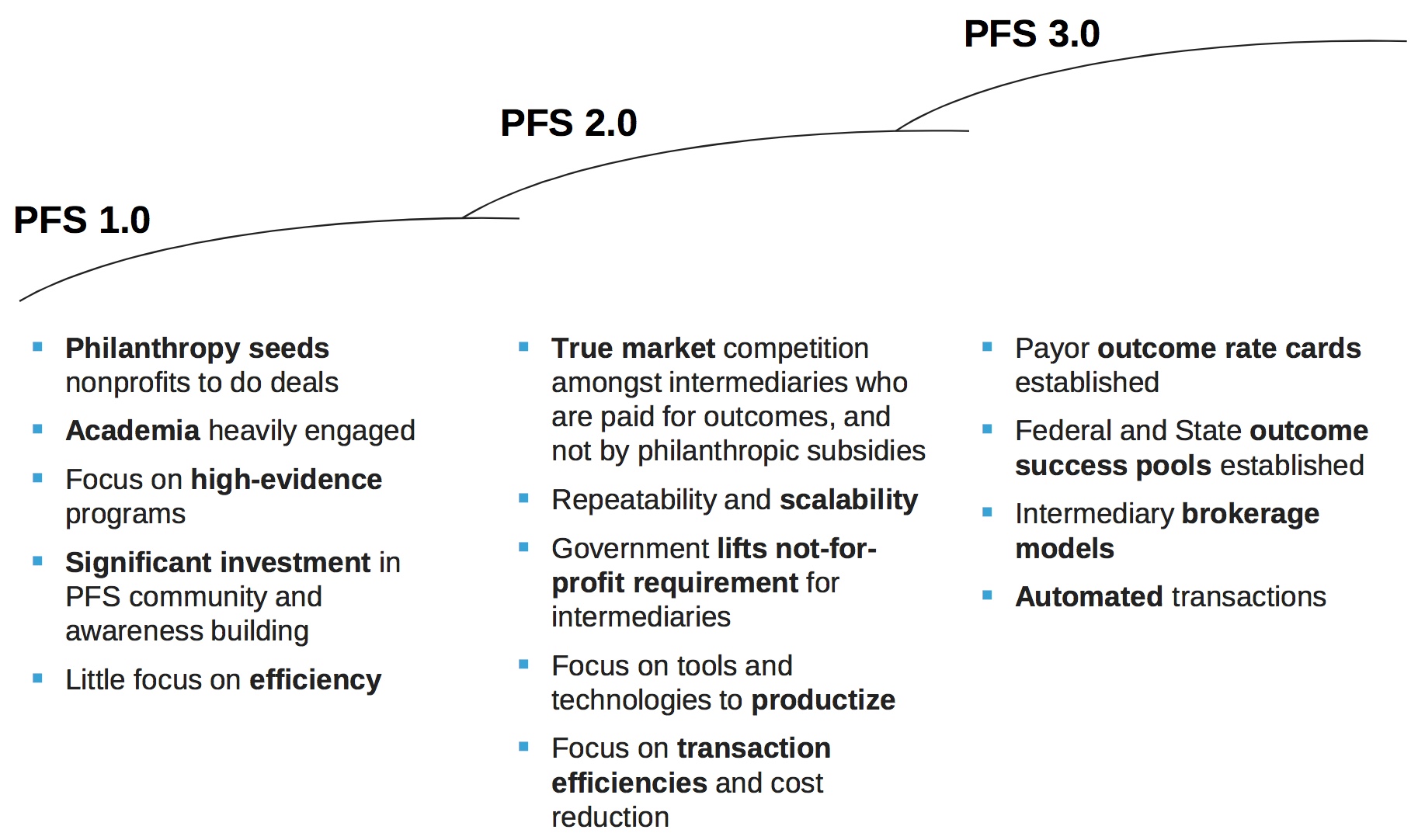

In order for the Pay for Success model to become a mainstream investment market, Quantified Ventures promotes the elimination of subsidies, the development of products from proven GSI tools and technologies, and improved transaction efficiencies and reduced costs. Source: Quantified Ventures